如何寻找超级成长股?世界首富24封股东信“吐露天机”:现金流比利润更重要(10)

2023-04-26 来源:飞速影视

Ouch。 Its been a brutal year for many in the capital markets and certainly for Amazon.com shareholders。 As of this writing, our shares are down more than 80% from when I wrote you last year。 Nevertheless, by almost any measure, Amazon.com the company is in a stronger position now than at any time in its past.We served 20 million customers in 2000, up from 14 million in 1999.Sales grew to $2.76 billion in 2000 from $1.64 billion in 1999。因此,公司今天的基本面比一年前好,为什么股价会相比一年前跌去这么多?就像著名的投资大师格雷厄姆·本杰明所说的,“股价短期是投票机,长期是称重机。”很显然在1999年的大泡沫中,投票机比称重机更主宰市场;我们是期望被称重的公司,所有的公司长期来说一定会被称重。随着时间的推移,随着我们的埋头苦干,我们希望成为一个越来越重的公司。

So, if the company is better positioned today than it was a year ago, why is the stock price so much lower than it was a year ago? As the famed investor Benjamin Graham said, ‘’In the short term, the stock market is a voting machine; in the long term, it‘s a weighing machine。’‘ Clearly there was a lot of voting going on in the boom year of ’99—and much less weighing。

Were a company that wants to be weighed, and over time, we will be—over the long term, all companies are。 In the meantime, we have our heads down working to build a heavier and heavier company。

相关影视

我是如何成为超级英雄的

2020/其它/动作片

在异世界获得超强能力的我,在现实世界照样无敌~等级提升改变人生命运~

2023/日本/日韩动漫

玛丽莲·梦露之谜:首次现世的录音

2022/美国/记录片

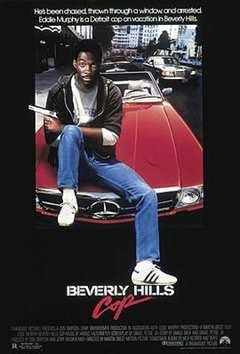

比佛利山超级警探

1984/美国/喜剧片

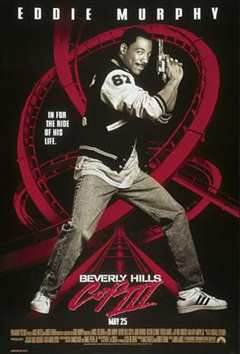

比佛利山超级警探3

1994/美国/动作片

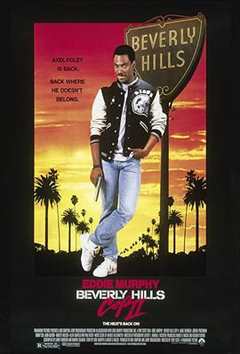

比佛利山超级警探2

1987/美国/动作片

合作伙伴

本站仅为学习交流之用,所有视频和图片均来自互联网收集而来,版权归原创者所有,本网站只提供web页面服务,并不提供资源存储,也不参与录制、上传

若本站收录的节目无意侵犯了贵司版权,请发邮件(我们会在3个工作日内删除侵权内容,谢谢。)

若本站收录的节目无意侵犯了贵司版权,请发邮件(我们会在3个工作日内删除侵权内容,谢谢。)

www.fs94.org-飞速影视 粤ICP备74369512号